Forex Trading Secrets Give Away Rights Ebook

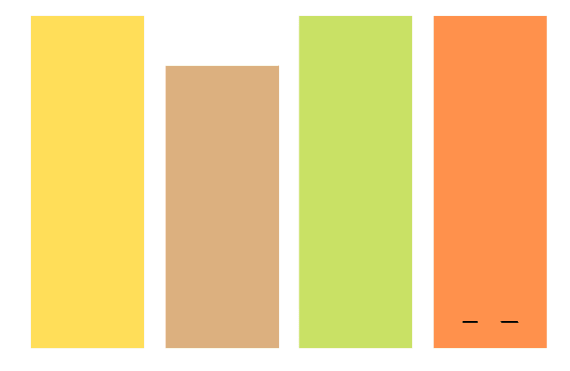

6 $

Sample Content Preview

WHAT IS FOREX?

Forex trading (foreign exchange) is one of the biggest markets that exist in the entire world and it is growing fast. It is estimated that a daily turnover in forex market is more than US $3 trillion dollars. Forex trading involves trading different currencies for the purpose of making profit.

The most common currencies traded are United States dollar (USD), Euro (EUR), Australian dollar (AUD), Canadian dollar (CAD), Swiss franc (CHF), British Pound (GBP) and Japanese Yen (JPY), although it is possible to trade virtually any currency of any country. Currencies are traded in pairs as buying one currency requires selling of another. The prices of different currencies in forex market vary constantly due to many different factors, while most of the currencies are stable in domestic market. Profit is gained from forex trading by utilizing buy low/sell high technique, but it is important to understand that if you buy one currency and later the price of that currency drops, you won’t be able to sell that currency for the price you bought it, but for lower price. This is good example how you can lose money with forex.

For example, you decide to invest certain amount of currency (US Dollars) to buy another currency (Euro). Now all you have to do is wait for Euro price to rise, or Dollar price to drop to a certain point and then sell Euros for Dollars. The result is that you will have more dollars than your initial investment.

Currency exchange rates in forex market are affected by many different economic and political factors including government’s surpluses or deficits, inflation levels, economic prosperity, trade levels, political stability/instability, etc.

There is also one factor that is very important to forex trading called market psychology and it can affect currency prices and increase/decrease demand for certain currency. For example, if one currency is generally perceived as stronger than the others, the demand for that currency will increase and the price will naturally be affected.

Forex market is very volatile market. Prices of currencies change rapidly every second, even in fractions of seconds! Prices are expressed as rates between two different currencies in pairs. If we have pair of currencies like EUR/USD, the first currency (EUR) is called base currency and the second (USD) is called the counter currency. Value of counter currency necessary to equal the value of 1 unit of base currency is represented by exchange rate. For example, if 1.4849 US dollars is equal in value to 1.0000 Euros, the exchange rate of EUR/USD is 1.4849.

Currency rates are quoted to the fourth decimal points with exception of Japanese Yen (quoted to the second decimal point). The smallest unit by which currencies may change in value is called pip. For example if price of Euro increases or price of US dollar drops, the rate between EUR/USD will increase. On the other hand if price of Euro drops or price of US dollar increases, the rate between EUR/USD will drop. If the previous rate was 1.4849 and the new rate is 1.4852, we say that the increase of rate is 3 pips. If the previous rate was 1.4849 and the new rate is 1.4845, we say that the drop of rate is 4 pips.

Other Details

– 1 Ebook (PDF), 11 Pages

– Year Released/Circulated: 2008

– File Size: 320 KB

License Details:

[YES] Can be packaged

[YES] Can be sold at any price

[YES] Can be offered as a bonus

[YES] Can be given away for free

[YES] Can add to free Membership Sites

[YES] Can be added into paid membership sites

[YES] Can convey and sell Personal Use Rights *

[YES] Can convey and sell Giveaway Rights *

[YES] Can be sold in dimesales, firesales, variable price sales or auctions, eBay.com…

[NO] Can extract the graphics for use elsewhere

[NO] Can convey and sell Resale Rights

[NO] Can convey and sell Master Resale Rights

[NO] Can convey and sell Private Label Rights